Nj Cash Buyers Fundamentals Explained

Nj Cash Buyers Fundamentals Explained

Blog Article

6 Simple Techniques For Nj Cash Buyers

Table of ContentsNot known Incorrect Statements About Nj Cash Buyers The Ultimate Guide To Nj Cash BuyersHow Nj Cash Buyers can Save You Time, Stress, and Money.Little Known Facts About Nj Cash Buyers.

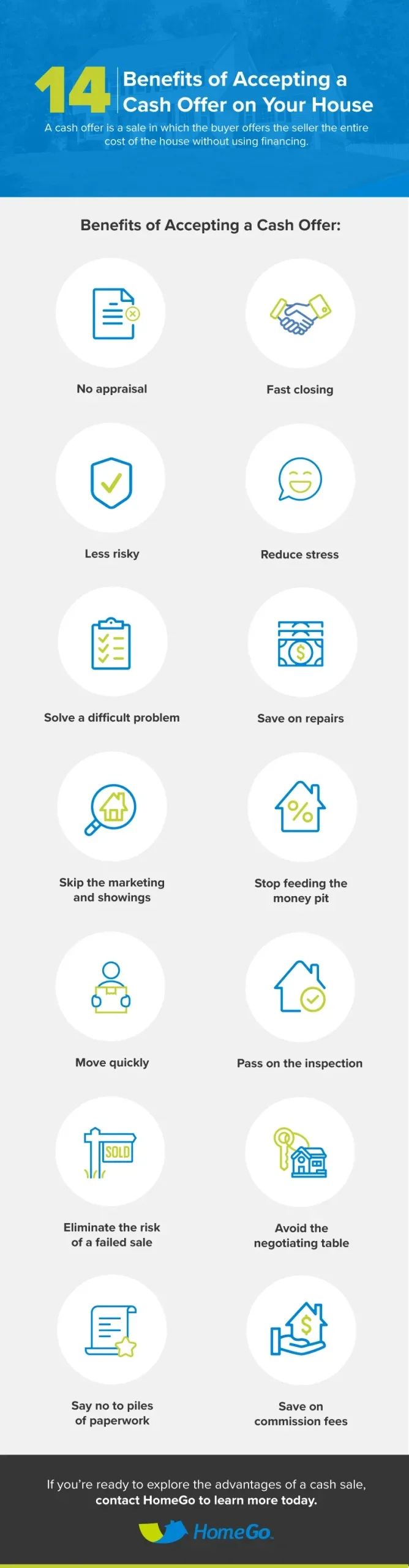

A lot of states grant customers a specific level of security from financial institutions regarding their home. Some states, such as Florida, completely exempt the residence from the reach of specific financial institutions. Various other states set restrictions varying from as little as $5,000 to approximately $550,000. "That means, no matter the worth of the house, financial institutions can not require its sale to please their insurance claims," states Semrad.You can still enter into repossession via a tax lien. If you stop working to pay your residential or commercial property, state, or government tax obligations, you could lose your home with a tax lien. Getting a home is a lot less complicated with cash. You do not have to wait on an inspection, assessment, or underwriting.

(https://medium.com/@njcashbuyers07102/about)I know that many sellers are extra likely to approve an offer of cash money, yet the seller will get the money regardless of whether it is financed or all-cash.

What Does Nj Cash Buyers Mean?

Today, regarding 30% of US homebuyers pay cash for their properties. There may be some great factors not to pay money.

You may have qualifications for a superb mortgage. According to a current research study by Money publication, Generation X and millennials are taken into consideration to be populations with the most potential for development as consumers. Taking on a little bit of debt, specifically for tax obligation functions excellent terms might be a much better alternative for your finances in general.

Maybe spending in the stock market, mutual funds or an individual company could be a much better alternative for you over time. By acquiring a residential property with cash, you risk depleting your book funds, leaving you at risk to unforeseen upkeep expenditures. Possessing a property entails continuous prices, and without a home loan padding, unforeseen repairs or renovations might stress your finances and hinder your capacity to preserve the home's condition.

The Greatest Guide To Nj Cash Buyers

Home costs fluctuate with the economy so unless you're preparing on hanging onto the home for 10 to thirty years, you could be far better off investing that cash money elsewhere. Getting a residential or commercial property with money can quicken the acquiring process considerably. Without the demand for a home mortgage approval and connected documents, the purchase can close faster, providing a competitive side in affordable realty markets where vendors may prefer cash buyers.

This can cause significant price financial savings over the long term, as you will not be paying interest on the loan quantity. Cash money buyers typically have stronger arrangement power when handling vendors. A money deal is much more attractive to vendors since it lowers the risk of a deal failing as a result of mortgage-related problems.

Remember, there is no one-size-fits-all solution; it's important to tailor your decision based on your specific conditions and long-term aspirations. Prepared to begin considering homes? Provide me a phone call anytime.

Whether you're selling off possessions for an investment residential property or are diligently saving to buy your dream residence, getting a home in all cash can considerably increase your purchasing power. It's a critical move that strengthens your placement as a buyer and boosts your flexibility in the real estate market. Nonetheless, it can place you in a financially prone spot (we buy houses for cash new jersey).

The smart Trick of Nj Cash Buyers That Nobody is Discussing

Minimizing passion is one of one of the most usual factors to buy a home in money. Throughout a 30-year home mortgage, you might pay 10s of thousands or also numerous countless bucks in total interest. In addition, your acquiring power raises without financing backups, you can discover a more comprehensive selection of homes.

The most significant threat of paying cash money for a residence is that it can make your finances unstable. Binding your fluid properties in a building can lower financial adaptability and make it a lot more tough to cover unanticipated expenses. Furthermore, binding your money means missing out on out on high-earning investment opportunities that might generate higher returns elsewhere.

Report this page